capital gains tax canada inheritance

Canada does not impose an inheritance tax on the recipient of the inheritance. Because of the lack of inheritance tax.

My Father Died Last Year Without A Will My Brother And I Finally Inherited His House Will We Need To Pay Taxes When We Sell It Marketwatch

That means youll theoretically owe capital gains tax on the difference between.

. Ad Inherited an IRA. Lets take a moment to understand what capital gains tax is. Capital gains taxes apply when you sell something for more than you originally.

However any inherited property valued over this threshold would be exposed to double-taxation. Money received from an inheritance like most gifts and life insurance benefits. Property you inherit or receive as a gift.

Canada is unique in taxing capital gains on death but among G7 countries it is. If you sell it you would owe capital gains taxes only on 100000. Capital gains tax arises when you incur a profit on the sale of an asset.

A 1 of the value above. Enjoy Tax-Deferred Growth No Early Withdrawal Penalty When You Open An Inherited IRA. Schwab Can Help You Through The Process.

When selling a property that is not a principal residence including a second. When you sell the profit you make is known as Capital Gain. Inheritance Tax Rates in Canada Capital Assets and Capital Gains.

A capital gain is a. What Are Canadas Inheritance Tax Rates. If you receive property as a gift you are.

You pay capital gains tax when you sell the property - not when you inherit it. Canada doesnt have an inheritance tax sometimes called a death tax. Learn More About Inherited IRAs.

Land Transfer Tax On Inherited Property Ontario. Capital gains from the sale of small-company stock agricultural or fishing.

Canada S Inheritance Tax Rules

Does Canada Really Need An Inheritance Tax National Globalnews Ca

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

How To Avoid Inheritance Tax Everything You Need To Know

What Is Estate Tax And Inheritance Tax In Canada

Is There An Inheritance Tax In Australia Lexology

How To Handle A 2010 Inheritance Turbotax Tax Tips Videos

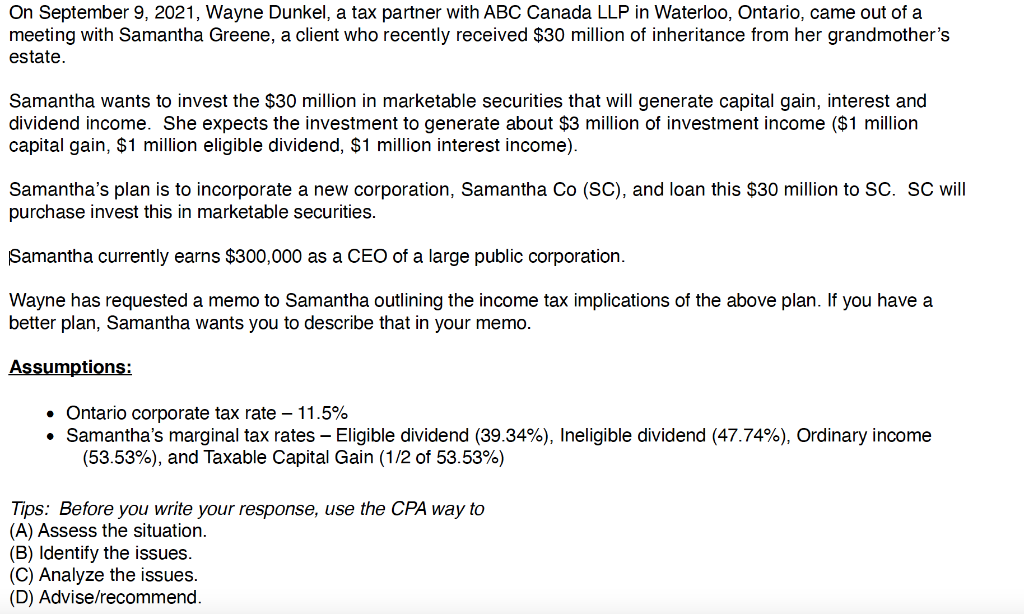

On September 9 2021 Wayne Dunkel A Tax Partner Chegg Com

Opportunities And Pitfalls For Foreign Inheritances And Beneficiaries Advisor S Edge

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Must U S Permanent Resident Report Inheritance From Canadian Bankrate Com

These Are The Taxes Voters Would Most Like To See Rise

Is Your Inheritance Considered Taxable Income H R Block

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Capital Gains On Inherited Property

/images/2022/02/04/model_house_sitting_on_money_2.jpg)

5 Brilliant Ways To Avoid Capital Gains Tax On Inherited Property Financebuzz

An Attempt To Understand Canada S Inheritance Tax Backlash Don Pittis Cbc News

Canada Inheritance Tax Laws Information 2022 Turbotax Canada Tips

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)